The Indian AC market seems to be in an exciting phase. The market forces of demand and supply, technology, weather, etc., seem to have joined hands to pull the product out of its slumber.

The consumer no longer sees this product as one on his wish list. With rising mercury levels, having got used to an air-conditioned environment in the office, malls, cinema halls, and hotels, it is a priority item on the shopping list. The yearning has spread to the Indian Tier-III and Tier-IV cities too. India has become the second-fastest growing market for room ACs, despite the lowest penetration among leading global RAC markets. 2019, having left the demonetization fiasco, migration to higher energy-efficiency standards, and initial pangs of GST behind is looking forward to the consumer loosening his purse strings.

The brands at their end have each introduced products designed specifically to cater to the needs of first-time and mid-segment AC buyers. Retail outlet presence has been expanded with ACs available at various sales points across the country.

The increase in customs duties on compressors in 2018 to 20 percent prompted manufacturers to enhance production capacity. Apart from the organized segment, the unorganized players continue to thrive as large components of air conditioners like compressors, IDU plastic, and electronic chipsets are imported from China, and manufacturing becomes essentially an assembly work without any entry barrier.

Indian market dynamics

The Indian room air conditioner market is projected to grow at a CAGR of 13.7 percent during 2019–2025. Split air conditioners dominate the market with an estimated 88 percent share and the trend is expected to continue. There is a continual shift toward inverter ACs, a key contributory factor being the merger of energy ratings for fixed and inverter compressors, and the decreasing price differential between fixed and inverter ACs.

By capacity, 1 to 2-ton room air conditioners account for the largest market revenue share in the overall India room air-conditioner market share. The typical average room size of an Indian household makes them best suited for consumers. The northern region has captured major share in the overall room air-conditioner market in India on account of improving residential sector, followed by the southern and western region.

The demand for comfort cooling is expected to drive the total stock of room ACs to over 1 billion by 2050, from about 26 million today. To put this in perspective, of the roughly 290 million households in India, fewer than around 20 million have ACs. Growth in the demand for cooling will be dramatic, particularly in urban areas, due to the underlying need for a solution to the problem of heat stress. Rising temperatures, population growth, and urbanization are only going to worsen the problem of heat stress in cities.

With greater development and the rise of incomes of the middle class in the country, many more people in India will make their first purchases of ACs to provide a better quality of life for their families. It is likely, though, that they will buy the lowest-priced AC units on the market, without taking into consideration the operating costs or emissions from their operation. Unfortunately, the most popular lowest-priced room AC units on the market today are inefficient and, if deployed at scale, will further burden India’s already strained electricity system. Air conditioning currently accounts for about around 40–60 percent of peak-power demand in summers in the major Indian cities of Mumbai and New Delhi, where there is the greatest concentration of air-conditioned buildings. To operate the projected stock of room ACs in 2050, approximately 600 gigawatts of new power generation capacity would be needed – equivalent to the installation of 1200 coal power plants of 500 megawatts each – which will require an investment of over USD 535 billion in new-generation infrastructure.

The Indian government recognizes people’s need for cooling, and realizes that an exponential rise in demand for cooling is inevitable, especially as such a rise is intrinsically tied to health and productivity outcomes. But it also understands the importance of meeting this need effectively and in a sustainable manner so that it does not result in runaway climate change or an energy crisis.

In 2019, India became the first major country in the world to develop a national policy document on cooling, the India Cooling Action Plan, which provides a 20-year roadmap addressing India’s future thermal comfort and the cooling needs of its people in a sustainable manner.

To promote the adoption of more energy-efficient ACs, the Bureau of Energy Efficiency defines the minimum energy performance standards for ACs and has been raising this efficiency performance requirement at nearly 3 percent every year. It has also developed a star label system to help raise consumer awareness about room AC efficiency.

With rapid scaling and adoption of a super-efficient and climate-friendly solution, India could avoid paying for nearly 400 gigawatts of new power generation capacity by 2050 – equivalent to saving nearly USD 380 billion, or a whopping 15 percent of India’s 2017 GDP.

Global scenario

Residential cooling demand will boom 3x globally, and increase by 5x in developing nations by 2050. By 2030, 4.5 billion room air conditioner units will be in use globally, compared to only 1.2 billion at present. Asia-Pacific represents the largest market and is considered to be the fastest-developing market in the global arena. The demand for air-conditioning systems in Asia-Pacific is expected to be driven by Japan, China, and India. South-east Asia market is projected to grow at a CAGR of 12.1 percent during 2019-2024, with Indonesia and Vietnam capturing key revenue shares in the overall market pie. Upcoming infrastructure upgradation projects in Malaysia and Thailand, coupled with new residential construction projects in Vietnam and Philippines, are expected to fuel the market for air conditioners in the region.

In the extremely competitive market, the air-conditioner players adopt various strategies, such as merger and acquisitions, expansions, joint ventures, and product development. Regulations related to energy-efficient utilization and an increase in customer awareness are anticipated to drive this regional market’s growth.

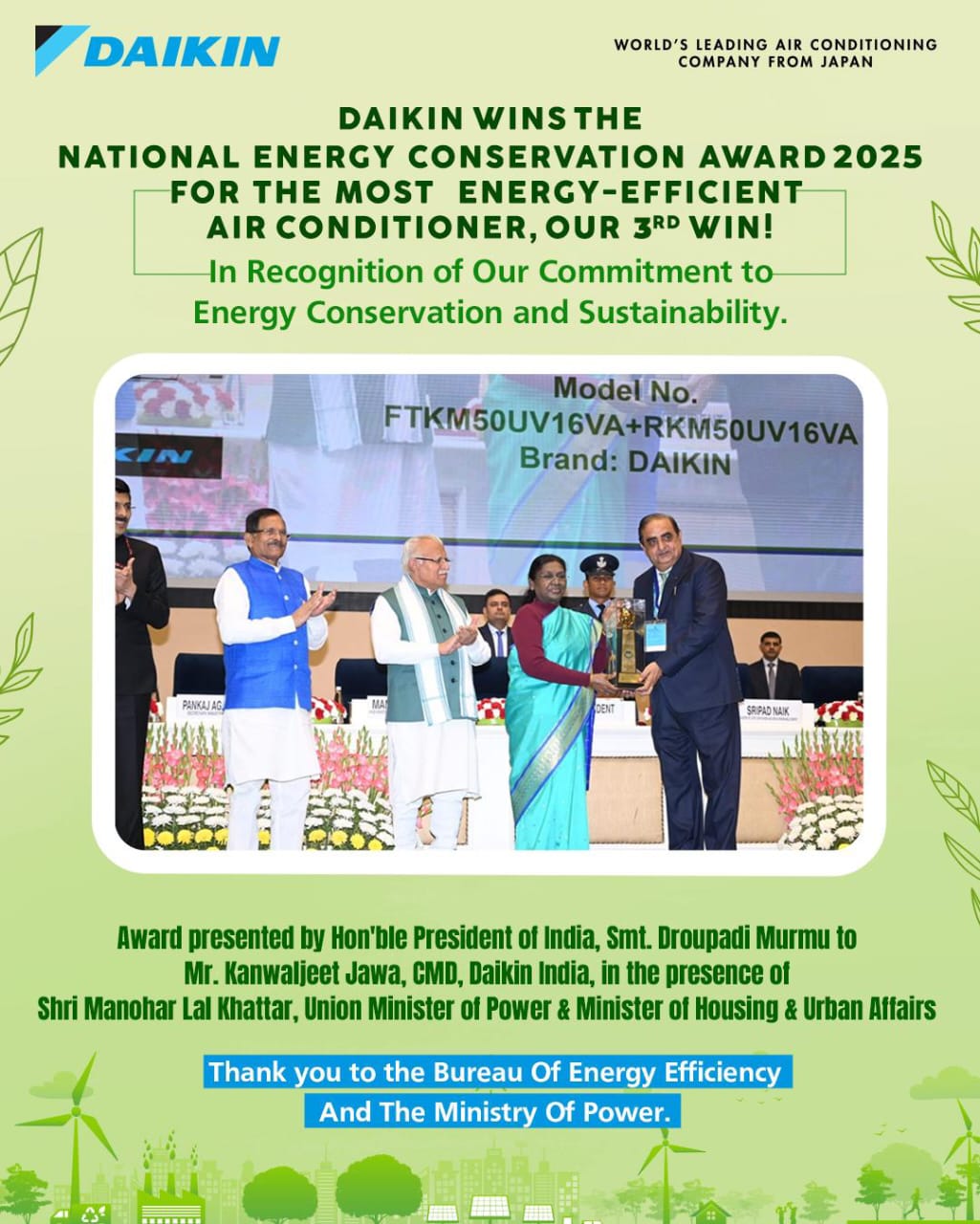

Major industry participants like Daikin Industries Ltd. are planning to set up new plants in Brazil, Argentina, and Mexico. In India too, Daikin has plans for its third manufacturing plant in South India. The AC maker is targeting a turnover of Rs 5000 crore in 2019-20 and Rs 6100 crore (100 billion yen) the following year. Adoption of HFC 32 refrigerant and inverter technology, segmenting the country broadly into five regions based on factors as climate, air quality and reliability of power supply and thereby selling locally tailored products, including Wi-Fi-enabled air conditioners and advanced anti-corrosion models, are some of the strategies which are poised to pay off.